7 Lessons for Leading in Crisis

Buy Now

Amazon

Synopsis

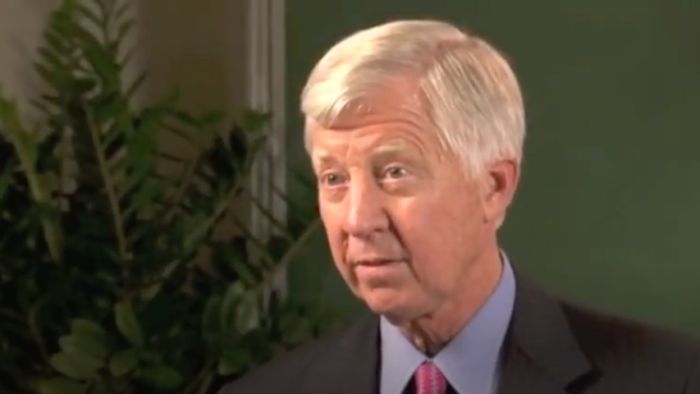

Bill George, the acclaimed author of Wall Street Journal’s bestseller True North and former CEO of Medtronic, draws from his own in-the-trenches experience and lessons from leaders (representing an array of companies) who have weathered tough economic storms. With straight talk and clear direction, George shows leaders specifically what they must do to become strong leaders and survive any crisis. His seven lessons:

- Face Reality, Starting with Yourself

- Get the World off Your Shoulders

- Dig Deep for the Root Cause

- Get Ready for the Long Haul

- Never Waste a Good Crisis

- You’re in the Spotlight: Follow True North

- Go on Offense, Focus on Winning Now

7 Lessons for Leading in Crisis is a concise handbook for applying proven leadership lessons in tough times – the must-read survival kit for anyone in a leadership position.

Start Reading 7 Lessons for Leading in Crisis

Download Your Free Copy of the Mini Study Guide

- Chinese (China)

- Estonian

- German

- Japanese

- Portuguese

- Romanian

- Spanish

- Vietnamese

- India